Understanding Cash App’s Fee Structure and Charges

Cash App has become a popular platform for peer-to-peer transactions, but many users may not fully understand its fee structure and potential charges associated with using the service. Cash App primarily generates revenue through transaction fees, which can vary depending on the type of transaction and method of transfer.

When users send money directly from their Cash App balance or from a linked bank account, the transaction is typically free. However, if users opt for instant transfers to their bank account, Cash App charges a fee of 1.5% of the transfer amount. This fee can catch users off guard, especially if they are not aware of it prior to initiating a withdrawal.

Furthermore, users may encounter transaction charges related to credit card payments, which incur a fee of 3% on the total amount. This is important for users who frequently use credit cards for transactions, as it can lead to unexpected deductions from their accounts. Additionally, if a transaction fails, users might still face potential fees depending on the specific circumstances surrounding that failure. It is crucial for users to review their transaction history and be mindful of the possible reasons their transfers may not go through as planned.

Lastly, while Cash App strives to be transparent about its terms and conditions, some hidden fees can arise from using features like Cash Card, the Cash App debit card. For instance, users may incur charges when using ATMs that are not part of Cash App’s network, which could lead to additional costs for withdrawals. Overall, it is essential for users to understand the nuances of Cash App’s fee structure to avoid unexpected charges and negative balances. By staying informed, users can navigate these potential pitfalls and utilize the app more effectively.

The Risks of Failed Transfers: How They Can Impact Your Balance

One of the significant concerns associated with digital payment platforms, such as Cash App, is the risk of failed transfers. When a transaction does not complete as intended, it can lead to unexpected complications, including negative account balances. Understanding how these failed transfers occur is vital for users who rely heavily on Cash App for their financial transactions.

Failed transfers can happen for various reasons, including insufficient funds, network issues, or incorrect recipient information. When a transfer is initiated, Cash App processes the request in real-time but faces potential pitfalls that result in transaction failure. If the transfer fails after an attempt to deduct funds, users may find themselves with a negative balance. This situation can be particularly concerning for individuals relying on the app for timely payments or bill settlement.

Furthermore, it is essential to note that Cash App does not always provide immediate or clear notifications about these failures. Lack of adequate alerts can exacerbate the situation, as users may remain unaware that a transfer has not been completed until they notice an unexpected charge or a negative balance. This notification gap can lead to financial mismanagement and, in some cases, additional charges if funds are insufficient for subsequent transactions.

Users should be aware of the underlying risks involved with failed transfers and take precautions such as verifying account details before initiating a transaction. Regularly monitoring account balance and transaction history can also help mitigate the impact of these failures. By understanding how failed transfers work and their potential repercussions, users can better navigate their financial responsibilities and maintain their account stability while using Cash App.

Exploring Alternatives: Why Users Are Turning to Other Payment Services

In recent years, digital payment platforms have gained immense popularity, with Cash App being one of the main players in the market. However, an increasing number of users are reconsidering their choice and turning to alternatives like Zelle, Venmo, and PayPal. The primary reasons for this shift revolve around the reliability of transactions and the user experience, especially in relation to unexpected charges and negative balances prevalent in Cash App.

Zelle, for instance, stands out due to its integration with major banking institutions, enabling seamless transactions directly from bank accounts without holding funds in a separate application. This feature not only ensures instant transfers but also minimizes the likelihood of unexpected charges associated with account management. The efficient operational structure of Zelle appeals to users who prefer a straightforward method without the complexities of additional fees.

Venmo, on the other hand, offers a more socially-driven approach to payments. With its emphasis on social interactions, users appreciate the ability to share transactions and communicate with friends directly through the app. Moreover, Venmo has been designed with transparency in mind, making it less likely for users to encounter surprise charges, which can often spoil the payment experience.

PayPal remains a longtime favorite, especially for online shopping and business transactions, due to its robust buyer protection policies and extensive merchant partnerships. This further assures users that their financial transactions are handled with a higher degree of security and care compared to experiences some have had with Cash App.

Overall, the movement toward these alternative payment services indicates users’ desire for more reliable and user-friendly financial tools. As concerns about unexpected charges and account issues continue to mount, it is no surprise that consumers are gravitating towards platforms that offer clearer terms and greater peace of mind.

User Experiences with Cash App

In today’s fast-paced digital economy, services like Cash App have gained immense popularity. However, user testimonials reveal a variety of experiences—some positive and others profoundly disappointing. Many users have reported issues with unexpected charges, leading to a growing frustration among consumers. One user recounted a scenario where a seemingly small payment led to a negative balance, surprising them when they checked their account. This unexpected charge not only disrupted their budgeting but also caused anxiety regarding future transactions.

Conversely, users have expressed satisfaction with other financial platforms, showcasing their preference for alternatives that are deemed more reliable. For instance, some users highlight platforms like Venmo or PayPal as more user-friendly, primarily due to their transparent fee structures and adept customer service. Testimonials about Cash App often contrast with the positive experiences described by users of these competing services, emphasizing reliability as a top concern.

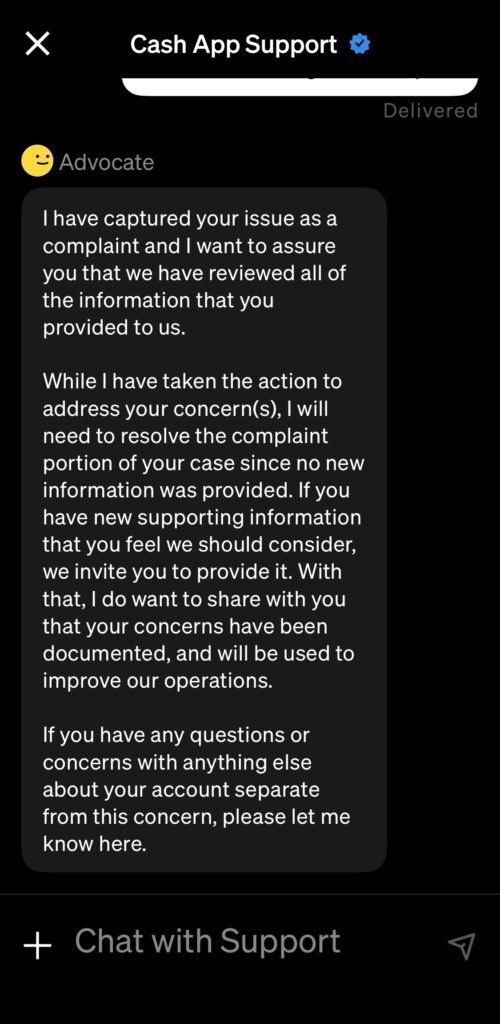

Furthermore, Cash App’s customer service has come under fire, with reports of long wait times and ineffective resolutions. One disturbed user recounted an instance where they faced difficulty reconciling a charge, requiring multiple interactions with support. In comparison, many users of competitor platforms reported swift resolutions to their inquiries, fostering a sense of trust and loyalty toward these services. This disparity in customer service experiences sheds light on a critical component of user satisfaction in the financial technology landscape.

Ultimately, these testimonials paint a complex picture of Cash App—highlighting its strengths, such as ease of use, alongside significant weaknesses, particularly regarding unexpected charges and customer support. Thus, while some users continue to advocate for its simplicity, others caution potential users to consider their options carefully, especially in light of these reported challenges.