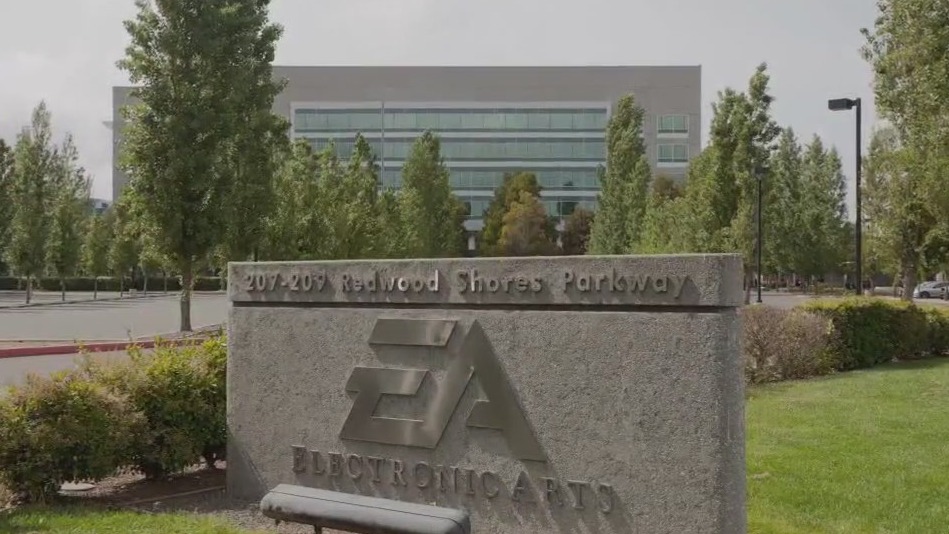

REDWOOD CITY, Calif. – Electronic Arts, maker of video games like “Madden NFL,” “Battlefield,” and “The Sims,” is being acquired for $55 billion, the biggest leveraged buyout attempt in history.

Under the terms of the deal announced Monday, the private equity firm Silver Lake Partners, Saudi Arabia’s sovereign wealth fund PIF and Affinity Partners will pay EA’s stockholders $210 per share. Affinity Partners is a private equity firm run by President Donald Trump’s son-in-law, Jared Kushner.

No longer a publicly traded company

If the transaction closes as anticipated, it will end EA’s 36-year history as a publicly traded company that began with its shares ending its first day of trading at a split-adjusted 52 cents.

SEE ALSO: John Madden, former Oakland Raiders coaching great and NFL legend, dies at 85

This marks the second high-profile deal involving Silver Lake and a technology company with a legion of loyal fans in recent weeks. Silver Lake is also part of a newly formed joint venture spearheaded by Oracle involved in a deal to take over the U.S. oversight of TikTok’s social video platform, although all the details of that complex transaction haven’t been divulged yet.

What will this mean?

By going private, EA will be able to reprogram its operations without being subjected to the investment pressures and scrutiny that sometimes compel publicly held companies to make short-sighted decisions aimed at meeting quarterly financial targets. Although its video games still have a fervent following, EA’s annual revenues have been stagnant during the past three fiscal years, hovering from $7.4 billion to $7.6 billion.

Meanwhile, one of its biggest rivals Activision Blizzard was snapped up by technology powerhouse Microsoft for nearly $69 billion in 2023, while the competition from mobile video game makers such as Epic Games has intensified.

The Source: Information for this story came from the Associated Press.

Leave a Reply