Controversy over the exclusion of the Strategic MSCI Index\n Competition to develop indexes such as Bitwise and Mantle\nTrusted ‘standard standards’ are essential\nThe shortage and concentration of verified assets are challenging

Recently, the cryptocurrency market fluctuated as the possibility of excluding Strategy (MSTR) from the MSCI index was mentioned in the U.S. stock market.

The spread of simple index change issues to the fear of the entire market proves the powerful dominance of the “index” in modern finance.

Tiger Research, an Asian Web3 research company, said in a report published on the 8th, “The S&P 500 or Nasdaq 100 index of traditional finance is not just a number, but a huge ‘watermark’ that moves trillions of dollars of passive funds,” citing the introduction of a ‘reliable index’ as a prerequisite for the maturity of the cryptocurrency market.

◆ The power of the index to create the “Tesla effect”… the spine of the money flow

The report cited the so-called “Tesla effect” to explain the impact of the index on the market. In the past, when Tesla was included in the S&P 500 index, the stock price soared not because of changes in corporate fundamentals.

This is because there has been a “structural demand” for index-following funds around the world to mechanically buy Tesla shares to match their portfolio ratios.

Tiger Research diagnosed that the current cryptocurrency market relies only on two huge assets, Bitcoin and Ethereum, and analyzed that standardized benchmarks that can read the flow of the market and execute investments beyond the fluctuations of individual coins are urgently needed in order for institutional funds to flow in earnest and reduce market volatility.

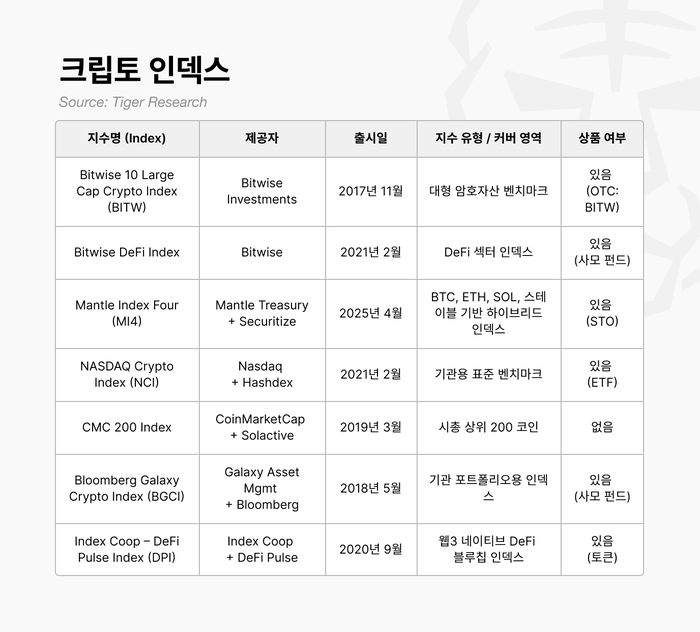

◆ From Beatwise to Mantle… An Evolving Crypto Index

In line with market demand, various players have already entered the competition for index development. Bitwise’s ‘BITW’ is considered the most representative ‘coin version of S&P 500’ oriented product.

It is the most traditional form of market capitalization weighted index and consists of the top 10 blue-chip cryptocurrencies. Bitcoin (about 74%) and Ethereum (about 15%) account for 90% of the total, virtually following the large stock market, and maintaining market representation by incorporating rapidly growing coins through monthly rebalancing and excluding falling coins.

New attempts beyond simple market cap tracking are also emerging. Mantle’s “MI4” is evaluated as the most evolved hybrid index.

Bitcoin, Ethereum, and Solana combined “stablecoin pools” to reduce volatility, especially in cooperation with Securitize to issue funds in the form of security tokens (STOs). This differentiates it from existing indices in that it also considers on-chain returns and liquidity.

In addition, indices that measure “prudential” and “market temperature” rather than simple rankings also attract attention. The Bitwise DeFi index contains only “verified DeFi” that institutional investors can trust and invest by screening risk factors such as hacking history or anonymous developers in advance.

In addition, the “CMC 200,” which includes the top 200 stocks after verification by German Solution, is used as an indicator of risk on and off across the market, and the “DPI (DeFi Pulse Index)” has become a “Web3 Native” product that can be traded directly on-chain by scoring token usage and activity.

◆ “Bitcoin is the only thing you can trust?” “Covering Jade Stone” is the pre-emptive task

![With BITW providing a large-cap digital asset benchmark, various players, including Nasdaq (NCI) and Mantle (MI4), are competing for market standard preoccupation. [Source = Tiger Research]](https://wimg.mk.co.kr/news/cms/202512/09/news-p.v1.20251209.cb57f4ad32644a7a9d6eb7f6fa6a1666_P1.png)

However, Tiger Research also clearly pointed out the limitations of the current cryptocurrency index market. Like blue-chip stocks in the stock market, there is an absolute lack of “proven assets (blue chips)” that anyone can hold for a long time without doubt.

The report pointed out that even the top 50 coins in market capitalization are divided among experts about their value and sustainability, and because of this uncertainty, investors still tend to be reluctant to index products that include altcoins other than Bitcoin and Ethereum.

In addition, individual investors’ “jackpot sentiment” was also cited as an obstacle to the index’s activation. Analysts say that the attractiveness of index products is relatively low because they tend to pursue alpha returns that increase dozens of times in a short period of time rather than stable market average returns.

“In the end, the success of the index is in line with the process of the cryptocurrency market itself maturing from ‘speculation’ to ‘investment,'” a Tiger Research official said. “A large inflow of institutional funds will begin only when reliable assets increase and regulatory compliance products such as ETFs and STOs, which contain them, are diversified.”

Leave a Reply